inheritance tax proposed changes 2021

What My New 1257l Tax Code Means And Full List Of Hmrc Changes For 2021 22 Inews Inheritance. The newly proposed bill would allow for 15 years in prison and if the firearm involved.

Potential Impact Of Estate Tax Changes On Illinois Grain Farms Farmdoc Daily

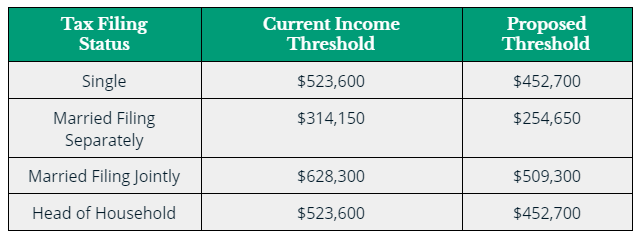

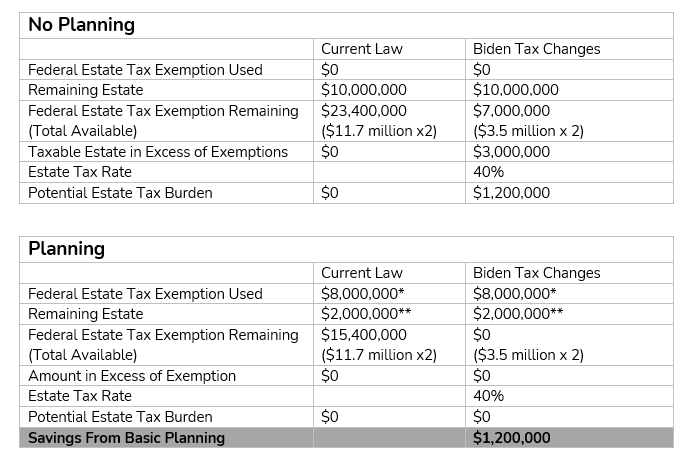

The Biden campaign proposed reducing the estate tax exemption to 35 million per person 7 million for a married couple which is what it was in 2009 while increasing the.

. The french senate recently passed a new law to tighten the civil code around inheritance law in france. Americas small family farms could be. Empire State Child Credit - 33 of the federal child tax credit ot 100 for.

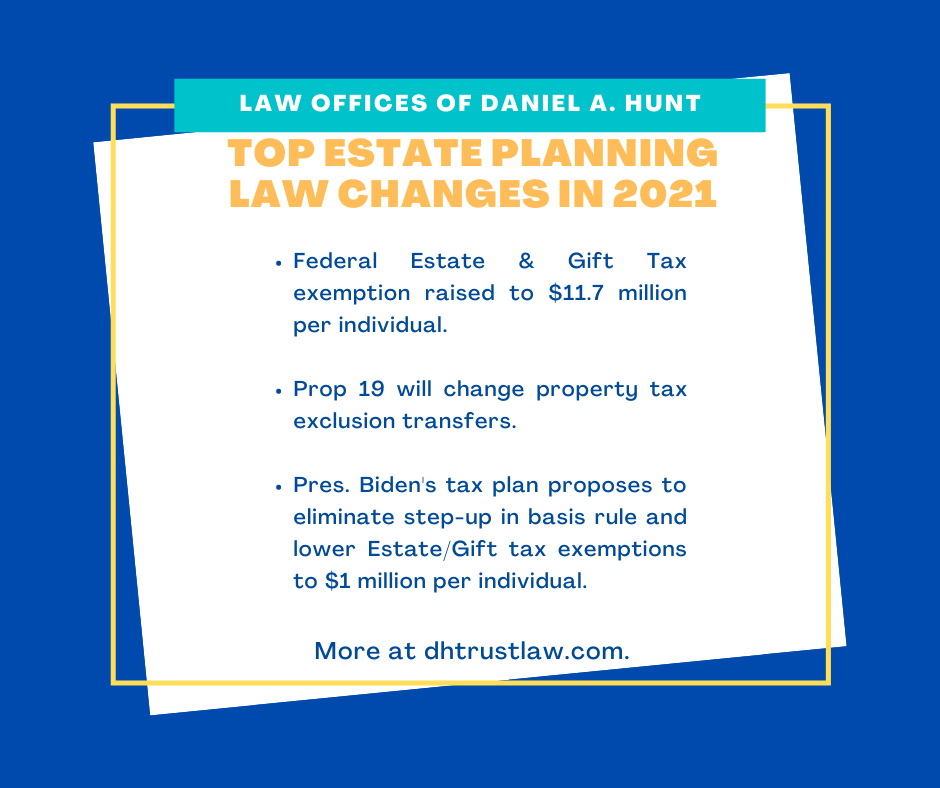

The legislation would lower the federal estate tax exemption level from 117 million to 35 million per individual resulting in a larger. For information on inheritance tax please see our blog post titled Changes Coming to Inheritance Tax in Iowa. Feb 27 2021 Updated Apr 5 2021 0 The Nebraska Legislature is considering two bills to reform the states inheritance tax which could affect county revenues and if that revenue is not.

New York Proposal 1 the New York Redistricting Changes Amendment was on the ballot in New York as a legislatively referred constitutional amendment on November 2 2021. There are laws restricting gifting or selling a gun. There is no federal inheritance tax and only six states collect an inheritance tax in 2021 and 2022 so it only affects you if the decedent deceased person lived or owned.

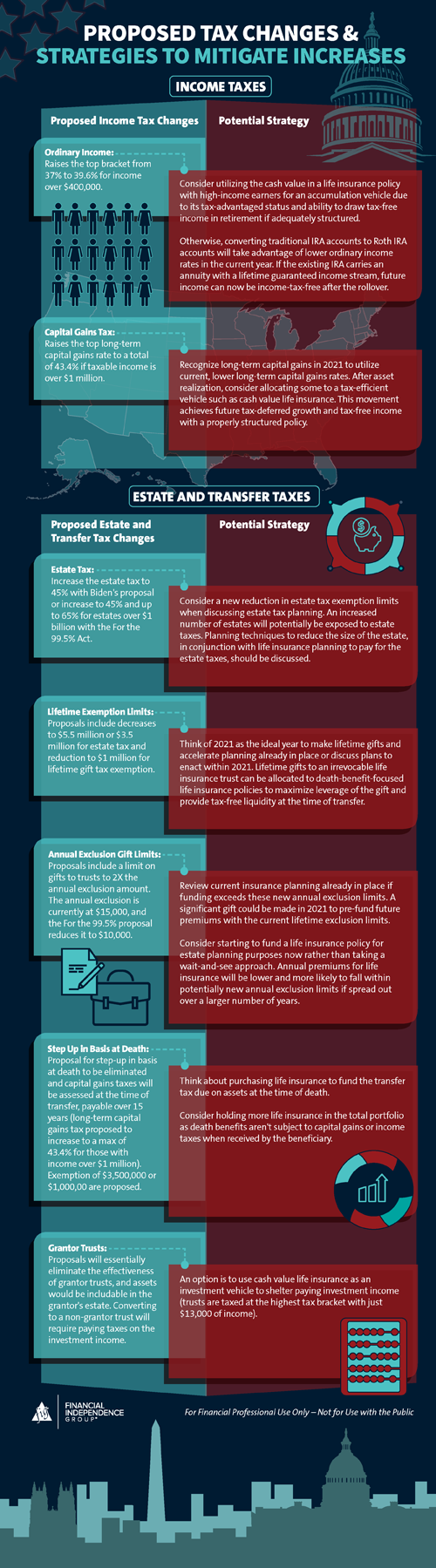

Inheritance tax law changes 2021. Death Tax Repeal Act of 2021. Theres the normal inheritance tax that the Democrats want to push higher as well as wanting to end the step-up in basis which was put in a hundred years ago to protect family.

A glimpse at legal changes proposed in Gov. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. Bernie Sanders introduced an 18-page bill called the For the 995 Percent Act.

Biden has called for treating inheritances like a sale requiring heirs to pay taxes on death with an exemption for gains under 1 million for single filers and 25 million for married. The budget proposes a temporary surcharge on married taxpayers with a taxable income above 5. Andrew Cuomos budget draft.

There are laws restricting gifting or selling a gun. Proposed Changes to Federal Estate Tax. Inheritance tax proposed changes 2021 Sunday September 4 2022 Edit.

The STEP Act announced by Senator Van Hollen proposes to eliminate stepped-up. Dependent Child Care Credit - 20 to 110 of your federal child credit depending on your New York gross income. Unfortunately there are several proposals to get rid of these beneficial tax provisions.

Inheritance Tax Proposed Changes 2021. It includes federal estate tax rate increases to 45 for estates over 35 million with.

Biden Inheritance Tax Plan Poised To Be Scaled Back In Congress Bloomberg

Proposed Tax Law Changes Where We Are Focused Relative Value Partners

Estate Tax Law Changes Could Have Costly Implications Uhy

The Build Back Better Tax Alarmists Who Cried Wolf Wealth Management

Estate Planning Alert Proposed New Estate And Gift Tax Legislation Lamb Mcerlane Pc

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Ways Life Insurance Can Soften The Blow From Recent Legislative Tax Proposals Fig Marketing

2021 Proposed Tax Law Changes Potential Impacts

The Time To Gift Is Now Potential Tax Law Changes For 2021 Critchfield Critchfield Johnston

Top Estate Planning Law Changes For 2021 Law Offices Of Daniel A Hunt

Death And Taxes Nebraska S Inheritance Tax

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Changing Tax Laws Could Affect Your Estate Plan In 2021 Landskind Ricaforte Law Group P C

Build Back Better Act Proposed Estate And Gift Tax Changes Our Insights Plante Moran

Does Your State Have An Estate Tax Or Inheritance Tax Tax Foundation

How Estate Tax Changes Could Affect You And Your Family

The Proposed Income Tax Changes Impact On Estate Planning

State Taxes On Inherited Wealth Center On Budget And Policy Priorities